Advantages of Whole Life Insurance You’re Not Supposed to Know

Most people miss the advantages of whole life insurance because they view it as strictly an insurance product that doesn’t do anything else. But it’s that perspective, not the product, that has the limitations.

Do you need to get the highest-quality life insurance you can count on, but you feel like life insurance agents are conspiring against you and sabotaging your success? Do you have questions about the advantages of whole life insurance, or maybe you need some tools to help you?

Podcast: Play in new window | Download (Duration: 48:41 — 55.7MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | Youtube Music | RSS | More

Well, look no further because this article will explain the various whole life insurance advantages, without you having to compartmentalize it as just buying death benefit, separate from the rest of your financial life.

Best of all, these seven benefits of whole life insurance will put you on the fast track to success with your life insurance right now.

Table of contents

Where Do the Advantages of Whole Life Insurance Policies Fit in the Cash Flow System?

Life insurance coverage in itself is just one small part of the bigger journey to time and money freedom.

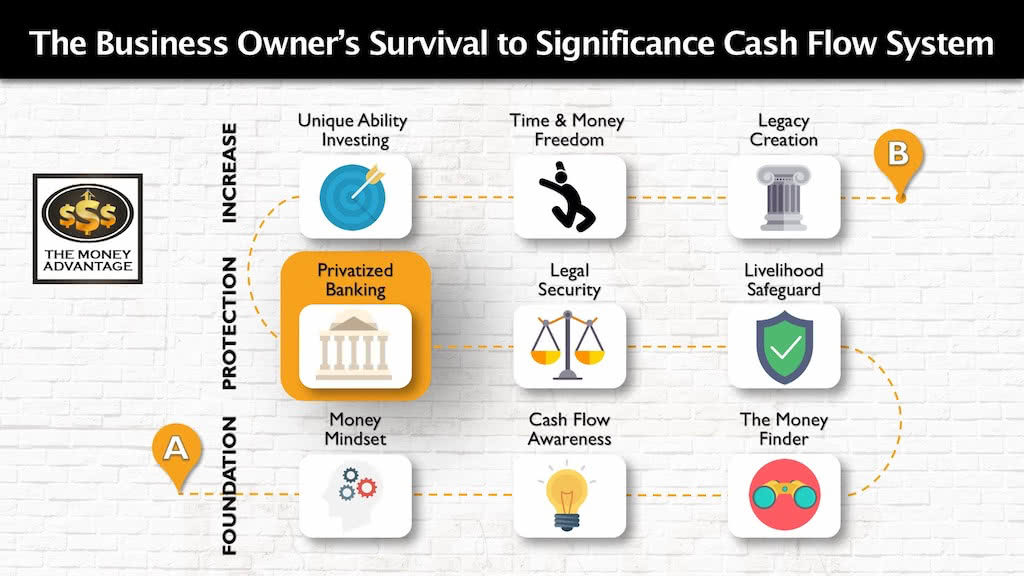

That’s why we’ve developed the 3-step Business Owner’s Cash Flow System. It’s your roadmap to go from just surviving to a life of significance, purpose, and financial freedom.

The first stage is the foundation. You first keep more of the money you make by fixing money leaks, becoming more efficient and profitable.

Then, you protect your money with insurance, legal protection, and Privatized Banking.

Finally, you put your money to work, increasing your income with cash-flowing assets.

That being said, whole life insurance designed for early cash value AND long-term growth fits the protection layer of creating wealth. At the same time, the Infinite Banking Concept improves every other area of your financial life.

Advantage of Whole Life Insurance #1: Vault-Like Safety

A whole life insurance policy is a savings vehicle, not an investment product. You can compare it to other savings tools, like checking accounts, savings accounts, money market accounts, and CDs.

Similarly, a whole life policy’s cash value is safe because it won’t drop in value.

This matters because your cash value is impervious to market crashes and corrections. It won’t drop in value unless you take the money out.

And if you take a peek behind the curtain to compare whole life insurance companies to banks, you’ll be impressed here, too.

Built-In Strength: Reserves and Reliability

Life insurance companies can make these profound guarantees mainly because of their long-term conservative investment strategy and their strong reserves. While many banks are required to keep only 10% in reserves, life insurance companies have more than 100% in reserves.

Notably, banks failed 27 times more than insurance companies during the years between 2005 and 2017. During those 12 years, there were 523 bank failures, while only 19 life insurance companies became insolvent. And those companies were small, poorly rated companies. The highly rated companies have stood strong for well over 100 years, through multiple economic crises.

Like the FDIC, which insures bank deposits up to $250,000, each state has a Guaranty Insurance Fund (GIF) that insures insurance. This level of long-term security is one of the practical advantages of whole life insurance — especially when compared with traditional savings tools.

Top that off with ensuring you’re working with the highest-rated, best life insurance companies. Then, you can be doubly, triply sure that whole life cash value is a savings tool that will guarantee your dollars will be there for you.

Advantage of Whole Life Insurance #2: Competitive Growth on Cash Value

A properly designed whole life insurance policy doesn’t scrimp on returns. In fact, when compared to other savings-type accounts, its guaranteed cash value benefits can often outperform traditional options over the long term.

But most people wouldn’t know that, because typical advisors don’t usually design insurance as savings tools.

In fact, when comparing premium payments with your resulting cash values in, say, year 20, whole life insurance policies typically yield an internal rate of return between 3% and 5%. That means that it would have required a consistent, positive, compounded growth rate every single year to turn the cash outlay into that account value.

Why Results Vary From Policy to Policy

Now, exact cash value growth, in terms of rates, can vary from whole life policy to whole life policy based on age, gender, and habits. But here’s what does matter: the return is after taxes and fees, and it’s in today’s low dividend-rate environment. Historical returns on whole life have been even higher.

Let’s put this in perspective. If you could get a 3% internal return in whole life insurance, compared to a 0.25% return in a cash savings account, that’s a full 12x higher return. Not too shabby!

And bonus points for whole life insurance: when you access your cash value through policy loans, all of your money keeps growing at compound interest, even while you use your money at the same time.

That kind of uninterrupted growth and flexibility is one of the overlooked advantages of whole life insurance — especially when compared to low-yield savings accounts or taxable investments.

So, not only is the whole life’s internal return competitive with other savings tools, but it’s also tax-advantaged and uninterrupted!

Advantage #3: Unlimited Access for Your Lifetime Cash Needs

If I’m going to stash my cash somewhere that’s safe and growing, I want to be able to access it so I can use it as well.

The great thing about cash value is that it is very liquid. You can use your cash value through loans or withdrawals, and in either case, the life insurance company has a contractual obligation to give you the cash.

Here’s how paying back a policy loan works.

If you have $50K of cash value, you can request a $50K loan. Then they’ll give you $50K of their money, secured against your cash value.

The best thing about this is that a whole life insurance policy loan doesn’t have any stipulations or requirements for what you’ll use it for, or whether you deserve it, or how and when you’ll repay. This means you can take a loan at any time, for any reason, without a cumbersome, time-consuming qualification process. And while it does accrue interest, you can pay it back over any period of time.

Freedom to Borrow on Your Terms

All in all, that means unlimited access to your cash needs throughout your lifetime. This is important because you can literally use the same money over and over again to pay for college, buy a house, purchase an investment, or anything else you might need through a process of taking and repaying policy loans.

And, you can also take your money out directly through withdrawals. In that case, you wouldn’t be able to put the money back, and you would pay tax on anything you withdraw above the amount you’ve paid in.

Advantage #4: Tax Savings

Tax is such a crucial piece of any financial tool because if you’re not careful, gains can be eaten up by taxes, especially in taxable accounts.

One of the distinct benefits of whole life insurance is that it’s one of the only tools where you pay tax once, and never again.

We call this the triple tax advantage.

Here’s how it works.

First, I pay tax on my income before I put it into my whole life policy. Then, I pay premiums. My money grows in a life policy tax-deferred. This simply means that I don’t have to pay tax every year on the growth of my cash value component or death benefit.

It implies I’ll have to pay someday … but if I utilize the policy correctly, I’ll never have to pay tax on that amount of money again. That’s because one of the advantages of whole life insurance policy loans is that they are tax-free.

And if I withdraw cash, as long as I don’t take out more than what I paid in, I won’t pay tax on the withdrawal. Then, when my beneficiaries – in my case, my family’s trust – get my death benefit, it’s income-tax free.

Avoiding the MEC Trap

One other thing. To get this triple-tax advantage, you need to make sure your life policy does not become a Modified Endowment Contract (MEC) by having too much premium and too low a death benefit. It’s one of the few technical areas that can affect the long-term advantages of whole life insurance. You would want to make sure your life insurance is designed to keep your policy on the straight and narrow, not veering into MEC territory.

A policy that becomes a MEC loses the tax-advantaged treatment and would be taxable anyway you access and use your money. That’s why this remains one of the most overlooked benefits of whole life insurance — you pay tax on the seed, and not on the harvest.

Advantage #5: Gateway to Income-Boosting Strategies

Whole life isn’t just an all-star player; it’s like a magic sauce that elevates the rest of the team as well. One of the coolest advantages of whole life insurance is that you can do more with your other assets. That’s because it becomes the token permission slip to maximize your income from other sources.

One income-boosting strategy when you have whole life insurance is a reverse mortgage. The reverse mortgage allows you to turn your home equity into an income stream. Then, instead of passing your house on to your loved ones, your death benefit replenishes your estate.

Spend More, Worry Less in Retirement

Another retirement income maximizer is the ability to spend down other assets, rather than trying to live off the interest and conserve the principal. Your life insurance cash value can serve as a buffer — one of the core advantages of whole life insurance — adding another layer of income predictability during volatile years. And again, even if you spend everything else, your death benefit becomes the inheritance when you pass away.

With whole life insurance, you can maximize your family’s Social Security income as well by delaying the year you start taking proceeds. Additionally, life insurance cash value that’s used for income isn’t taxable (see above), so your total income stays lower and less is subject to taxes.

These types of income-layering strategies are often discussed in our Privatized Banking approach — and they’re part of what makes whole life insurance so uniquely powerful for long-term income planning.

Additional income in later years matters because if you live a long time, you’d enjoy life so much more if you weren’t worried about your money running out.

Advantage #6: Privacy from Creditors and Lawsuits

Privacy is another leverage point that whole life insurance offers. It provides a level of financial discretion that’s hard to match elsewhere. There’s no public interface to look up who has it and how much they have.

While this advantage is state-specific, whole life asset protection is available in many states, with either partial or full protection from creditors and lawsuits. That means that if you’re late on your mortgage, they can’t garnish your whole life insurance.

You’d need to talk with your advisor to see exactly how that applies to you.

One area of privacy that anyone can take advantage of is that the cash value doesn’t count against your ability to get federal student loans. That’s because you don’t list life insurance anywhere on a FAFSA for college or grad school. So you could have a lot of cash in whole life policies and still qualify for maximum grants and loans.

This kind of financial privacy is one of the main benefits of whole life insurance and can help protect your savings while keeping your options open — both for education and beyond. The privacy and creditor protection of a permanent life insurance policy are the icing on the cake.

Advantage #7: Legacy Preserver

And here’s the cherry on top. Whole life insurance is the hands-down most efficient way to keep your legacy intact and pass it down. It’s a practical way of leaving a financial legacy with whole life insurance that your heirs can actually use.

Whether you’re gifting your grandchildren, children, husband, trust, charity, business, business partner, or someone else, you don’t have to worry about this asset being slimmed down by taxes or slowed down by probate.

A whole life insurance policy travels through the generations far more nimbly than a physical property or stuff that might not be easily divisible, or other assets that might have your heirs paying your taxes. Which is not exactly how you want to be remembered. It’s also one of the simplest tools available for preserving intergenerational wealth without tax complications or probate delays.

Unlike other types of life insurance (term life insurance, universal life insurance, variable life insurance), a whole life insurance policy guarantees a death benefit will complete and maximize your estate and transfer your legacy so you can live beyond yourself.

Pros and Cons of Whole Life

While most people need life insurance, whole life insurance is not the solution for everyone. Here are a few reasons whole life insurance is not a good fit:

- Savings is not a current priority for you

- You lack the discipline to make consistent premium payments and pay back loans

- You have to go through medical and financial underwriting and qualify

Find out More

There you have it.

Overall, these seven advantages of whole life insurance policies put some real power in your corner as an investor. But don’t forget, there’s a lot more to a whole life insurance policy, especially if you want to get the highest-quality life insurance you can count on.

So don’t let this article be the end of your journey, but rather the beginning of your quest for more knowledge.

By the way, if you want a lot more detail about whole life insurance, check out our free guide and video training The Quick and Easy Guide to Privatized Banking for Investors for all the answers you need.

FAQs About Whole Life Insurance Advantages

What are the main advantages of whole life insurance?

The biggest advantages of whole life insurance include guaranteed lifetime coverage, fixed premiums, and the ability to build cash value over time. It also provides long-term tax benefits and financial privacy.

How do the benefits of whole life insurance compare to term life insurance?

While term life insurance offers coverage for a set period, the benefits of whole life insurance extend well beyond that. It doesn’t expire as long as premiums are paid during the premium-paying years, and it includes a growing cash value component you can use during your lifetime. Even if you stop paying premiums later on, there are several options available to keep the policy in force—such as using dividends, cash value, or reduced paid-up status.

Can the cash value be used while I’m still alive?

One of the practical whole life insurance advantages is the ability to borrow against your policy’s cash value or make withdrawals. This gives you access to funds for emergencies, investments, or other goals without selling assets or incurring taxes.

Are there tax advantages with whole life insurance?

Absolutely. Your cash value grows tax-deferred, and policy loans are tax-free. Plus, the death benefit passes to your heirs income-tax-free — one of the lesser-known but powerful benefits of whole life insurance.

Is whole life insurance worth the higher premiums?

For those looking for long-term security and flexibility, the advantages of whole life insurance often justify the cost. It’s not just about protection — it’s a financial tool that supports multiple strategies over time.

Marshall Family Banking System Case Study: In-Force vs Original Illustration (Part 6)

The moment we realized “liquidity” isn’t a theory Thirteen years ago, Lucas and I thought we were being responsible by storing a lot of our capital in gold and silver. It felt safe. It felt timeless. It felt like the kind of move people make when they’re thinking long-term. And then we needed cash. Not…

Emergency Fund Alternatives: Liquidity That Protects Your Family—Without Sacrificing Growth

The Day the “Emergency Fund” Met Real Life Rachel here. Many tell us the same story: “I saved the emergency fund, but I’m worried I’m losing ground to inflation and missed opportunities.” Because for most people, the “emergency fund” is a lonely pile of cash—stuck in a corner doing next to nothing. It feels safe,…