Dr. Robert Murphy: Infinite Banking – Increasing Capital and Cashflow

Robert Murphy discusses an out-of-the-box strategy, Infinite Banking, that complements the entrepreneur. He is an economist in an unconventional wrapper. His sense of humor and straight-talk help him convey the most difficult concepts with elegance and simplicity we can all understand. He’s a free market thinker with the courage to be contrarian.

He goes against the grain of the financial and economic status quo that marginalizes entrepreneurs and disregards their primary needs. Instead, he salutes the nobility of entrepreneurship. He gives clear-cut guidance on how to fortify their financial footing with cash flow and control of capital.

Podcast: Play in new window | Download (Duration: 50:42 — 46.4MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

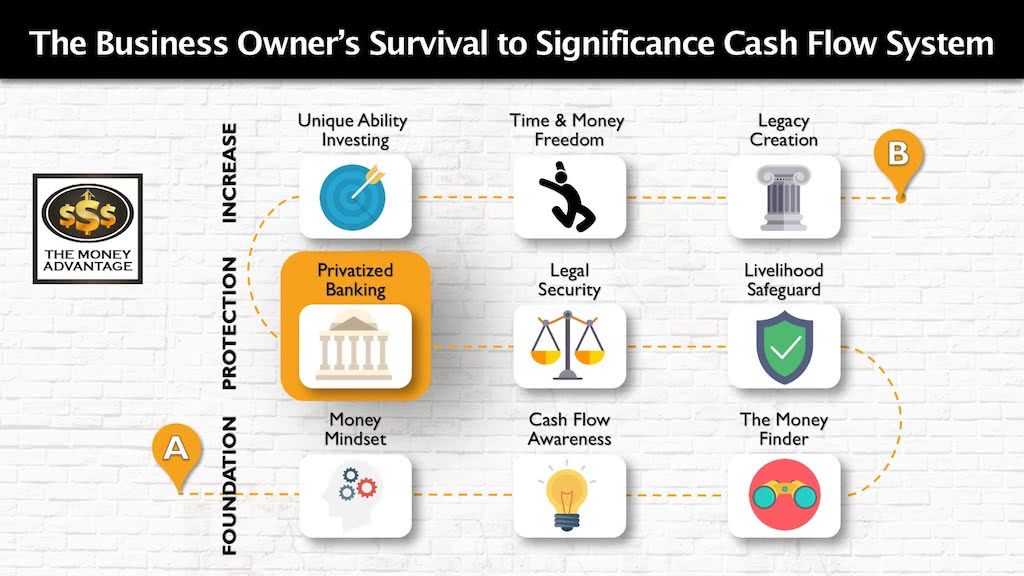

Where Infinite Banking Fits into Your Cash Flow System

Infinite Banking (Privatized Banking) is just one step in the greater Cash Flow System.

Infinite banking is sandwiched between Stage 1, where you’re being more efficient and keeping more money you already make, and Stage 3, where you’re increasing cash flow from your investments.

While it’s nestled into Stage 2, Protection, it also improves everything else around it. Infinite Banking helps you keep more of the money you make in Stage 1, amplify your cash-flowing asset strategy in Stage 3, and accelerate your Time and Money Freedom.

Robert Murphy Has Credentials That Have Earned Him Wide Respect

Robert P. Murphy is an

Robert has a Ph.D. in economics from New York University. He is also Senior Economist with the Institute for Energy Research, Senior Fellow with the Fraser Institute, Senior Fellow at the Mises Institute, and Research Fellow with the Independent Institute.

He’s a prolific author and speaker on Austrian economics.

Robert Murphy has testified before Congress on energy markets and monetary policy and has given numerous interviews on TV and radio. He is the author of hundreds of articles and several books on economic topics created for the layperson.

He publishes (with Carlos Lara) the Lara-Murphy Report, and is co-creator of the IBC Practitioner Program.

He’s a member of the board at the Nelson Nash Institute.

His works have been published in:

- The Austrian

- Mises Daily Article

- The Journal of Libertarian Studies

- Quarterly Journal of Austrian Economics

- Mises Review

- The Free Market

- Review of Austrian Economics

- Speeches and Presentations

Robert Murphy Interview Highlights

The Human Element That Makes Economics Unpredictable

Robert Murphy makes economics simple and relevant to everyday people making everyday life decisions.

While mainstream economics is often confusing, he gives people the tools to understand the world around them and make decisions.

Robert starts by casting off a general assumption that economics is fundamentally math. He brings the human element front and center, writing in his book, Lessons for the Young Economist.

“Economics always involves the operation of at least one mind, intelligence that has conscious goals and takes steps to influence the material world in order to achieve those goals.” ~ Robert Murphy

Economics has individual actors that you can’t put into a mathematical model. They aren’t going to consistently do the same thing, like in a science lab. He says:

“Economists face two huge problems: the objects of their study have minds of their own, and it’s much harder to perform a controlled experiment in economics than it is in natural science.” ~ Robert Murphy

If you attempt to treat the social sciences like the physical sciences, it gives a false concept of precision. People are much more complicated than atoms and molecules.

Real-world economics has to account for an unknown future, and best equip us to flourish in any environment.

Austrian Economics Celebrates the Entrepreneur

Entrepreneurs, of all people, have an unquenchable thirst to control their future. They, also more than most, recognize that the world is continually evolving, and value keeping themselves agile to innovate and improve continuously.

Because of this, they value making decisions today that expand their options tomorrow.

They build businesses by continually honing their perspective, their understanding of the problems, and their skillset to solve it.

Entrepreneurs long for environments that support and celebrate their creative spirit. They crave the ability to make decisions that fit their business’ economy, financial picture, situation, and goals.

But often, the mainstream, one-size-fits-all financial thinking doesn’t fit the entrepreneur at all.

With the mainstream economic model that’s taught in textbooks and Ivy League schools, there’s no entrepreneur and no role for the entrepreneur. Mainstream economics finds the equilibrium point where everything is already adjusted, and the system is at rest. But that’s not reality.

The Austrians stress the importance of the entrepreneur’s role to move the system towards equilibrium by realizing profit opportunities in the real world.

The Austrian Business Cycle Theory Informs the Entrepreneur

The Austrian Business Cycle Theory, developed by Ludwig von Mises and elaborated by his followers like Fredrick Hayek and others, does the best at explaining the boom and bust cycles in the market.

Mises said the cause of the boom/bust cycle was that interest rates were pushed to artificially low levels. As a result, banks would inject credit into the economy. The modern regulation of the institutional banking system, the Federal Reserve, and central banking all play a role as well.

Low-interest rates give a false signal to businesses, causing the euphoric boom.

The opposing Keynesian view is used by Federal Reserve officials. From this perspective, the response to a bad economy is to lower interest rates.

Austrians believe lowering interest rates just sets up the economy for another crash.

Protect Your Ability to Innovate by Controlling Your Capital

The optimism during the run-ups in the economy is often fostered by people who are not looking at things in an entrepreneurial way.

You’ll miss all the underlying factors if you just look at scientific economics models.

Business owners who understand the dynamic between interest rates and the market cycle have their eyes open. They don’t get sucked into the hype when the economy looks good. They recognize when it’s false prosperity.

The business owner is safer when they are more independent. With their own funding system in place, they are not dependent on a bank that can shut down access to capital if credit tightens up.

How Robert Murphy Connects Austrian Economics with Infinite Banking

When Robert Murphy met Carlos Lara, Carlos was giving presentations to bankers showing them how the banking business worked, and how the modern banking system was “blowing up the world.”

Carlos would explain the fractional reserve system to them. When customers make bank deposits, the bank lends out more than customer deposits. The banking system consequently creates money by lending activity.

When banks expand credit in times of prosperity, it expands business. When the economy turns downward, the bank restricts credit, and businesses that need capital aren’t able to access it.

Robert Murphy and Carlos Lara Host the Night of Clarity

Carlos and Bob began working together to host The Night of Clarity in 2009, an event that discussed the state of the economy and gave clarity as to what could be expected in the future. The event featured big-name speakers like Ron Paul and David Stockman, who discussed Austrian Economics.

The connection between Austrian Economics and Infinite Banking was Nelson Nash, who discovered the Infinite Banking Concept. He saw that you could use whole life policies structured a specific way to “become your own banker.”

Carlos Lara and Bob Murphy demonstrated that the Infinite Banking strategy is a great way to shield yourself from the chaos in the broader economy.

The Entrepreneurial Mindset

We would like to make a distinction in how we define business owners and entrepreneurs. The difference is in their thinking.

A business owner has purchased a job. They don’t innovate or look to save money. They’re often undercapitalized. During economic problems, they often become the lowest paid employee of the business, because they don’t have anything to fall back on.

The entrepreneur, on the other hand, is always innovating. To do that, they value storing capital and sit on cash for the right opportunities.

Infinite Banking Is the Perfect Savings System for Entrepreneurs

The customary place to store money is in the bank. People have been conditioned to believe that if money is in the bank, it’s safe. However, if the bank doesn’t have enough money, it can be shut down.

The volume of capital required during the last banking crisis caused the FDIC to be underwater for a while. They had to get a loan from the federal government and pre-charge premiums to fix their balance sheet. There’s a small sliver of money in the FDIC earmarked to cover all the bank deposits in the country. Looking forward, if there’s another major crash, there’s not enough to keep you safe.

To provide the maximum security of their capital, entrepreneurs can use the approach of Infinite Banking (Privatized Banking).

Specially Designed Whole Life Insurance is a way to keep capital in a relatively secure place, so you can use it to grow.

Bob Murphy Went From Whole Life Insurance Skeptic to Evangelist

Robert Murphy was an economist and then a consultant, writing primarily for Free Market websites to educate the public on economic issues.

He received his first introduction to infinite banking from Carlos Lara but was initially skeptical.

Bob Murphy read Nelson Nash’s book, Becoming Your Own Banker. He thought Nelson was a nice guy with nice ideas, but as a trained economist, he didn’t think the ideas made sense at first. Having no familiarity with permanent life insurance, he didn’t understand how it worked.

Bob did his due diligence by reading insurance books and talking to actuaries of life insurance companies. When he vetted infinite banking from his own perspective and interpreted what Nelson Nash said from the framework that he was familiar with, he saw that it was quite simple.

Eventually, as Bob’s understanding flourished, he and Carlos co-authored the book, How Privatized Banking Really Works.

Five years ago, Bob started his own infinite banking system with a Specially Designed Whole Life Insurance Policy. He’s now a personal user and evangelist for infinite banking. However, to this day, he is not a licensed agent and does not sell or receive a commission from the sale of life insurance.

He explains that the special design of a whole life insurance policy used for infinite banking builds up cash value much more quickly, compared with a standard whole life policy.

Bob went on to develop the Practitioner’s Program with the Nelson Nash Institute, in-depth training for financial services professionals who implement the infinite banking concepts with their clients.

Robert Murphy on What Makes the Infinite Banking System Good for Business Owners

Pointing to easy access to your cash value with the guaranteed loan feature, Robert Murphy says that he uses his life insurance in conjunction with his business. If he has a cash flow problem, he calls up the life insurance company, and they send him a check in the mail.

A life insurance policy loan is similar to borrowing against the equity in your house with a home equity line of credit (HELOC), except without the red tape.

The difference is this: if you want to get money out of your house, the bank will run your credit score, ask you your sources of income, and find out the purpose of the loan. The reason is that, if you default on the home equity loan, they will ultimately have to seize your home and sell it to get their money back.

Conversely, when you call up the life insurance company to get a policy loan, they are themselves, guaranteeing the collateral: your cash surrender value. Even if you don’t pay them back, they’re fine. Either when the death benefit pays out, or if you surrender your policy, the life insurance company is made whole.

The life insurance company doesn’t do a credit check. They don’t care if you have income or not.

The accessibility of your cash value is why “being your own banker” with this asset structure works so well.

Another advantage of using whole life insurance over a HELOC is this: With whole life insurance, the surrender values have guarantees, so you get guaranteed compounded growth.

With home equity, there’s no guaranteed growth, and you can lose value, so the collateral you thought you had available to repay the loan isn’t there for you.

Infinite Banking Is Your Tool to Emulate the Most Powerful Business Model in the World: The Bank

Robert Kiyosaki has commented about the End the Fed movement. He has said that people sometimes get caught up trying to replace something that’s been around for a long time and encourages them to put their energy into “being the Fed” instead.

Kiyosaki is talking about controlling capital and creating streams of cash flow, just like the banking system does.

Reclaiming the banking function using whole life as a privatized banking system is another way to do that.

Robert Murphy Says You Can Seced from the Banking System

That’s the same message Carlos Lara and Robert Murphy were sharing in How Privatized Banking Really Works. You as a household and business can protect yourself by “seceding” from this broader network. It does not require getting public opinion on your side. You can take action immediately. When you control your own capital, you’re not contributing as much to the broader economic problem.

The only way the commercial banks can push interest down, expand credit, and cause a business cycle is if there’s someone on the other side taking out the loan.

To the extent that Americans turn to their own privatized banking systems, rather than going to a regular banker to get a loan, the problem would be more contained. Infinite banking is not only in your own self-interest, but it helps limit the problem socially.

It comes down to personal responsibility to build savings, which helps the business owner grow. It also keeps the economy from going through boom and bust cycles, by limiting the expansion of credit.

An Infinite Banking Policy Is Like a Swiss Army Knife

Like a Swiss army knife can do multiple jobs, but it’s just one tool, a Specially Designed Life Insurance Policy can meet many of the business owner’s needs.

One policy used for Infinite Banking can replace the banking function, while also:

- Providing a safe place to store capital

- Protecting the business against the loss of revenue due to the loss of a key employee with key man insurance

- Funding your exit planning strategy in your business

- Retaining employees with a deferred compensation plan

- Serving as the foundation for estate planning to help you transfer assets to the next generation

For businesses with the primary goals of taking care of cash flow and your employees, life insurance is a multifaceted solution that fulfills multiple roles at the same time.

A Good Rate of Return, Compared to What?

Storing your money in the bank (at the time of this writing) gives a guarantee of 0.07% or so, currently well below 1%. If you have money sitting in checking accounts, the purpose is to have it liquid and safe. The rate of return is a lower priority.

The rate of return on whole life insurance is a net, after-tax 3 – 5% (based on mutual insurance companies’ dividend scales today).

Compared to the bank, life insurance has excellent returns. It stacks up well against other options for low-risk places to store cash.

The tax benefits make it much more competitive because whole life insurance growth is an after-tax rate, net of all fees, commissions, costs of insurance, and cost of running the company.

In fulfilling the need to have a great place to store cash, whole life insurance policies are quite robust.

Infinite Banking Is Most Powerful as an “AND Asset”

Whole life insurance is a place to store cash. It gives you safety, liquidity, and growth on your capital. That’s just if you had a whole life policy and did nothing with it.

It’s not an investment, nor an investment replacement. You don’t “invest” in life insurance.

While storing your capital in this vehicle, you can tap it, meaning that you can access and use your money.

If you put your capital into something like a 401(k), it is locked in prison until you retire.

Because you can use your cash value, you don’t have to choose between life insurance and your preferred investments. You can still invest in your favorite asset classes, AND store cash in whole life insurance at the same time.

For example, if you like gold because you’re concerned about the collapse of the dollar due to quantitative easing (QE), keep your gold.

When you use it as a place to store cash, borrow against it, and put it to work in other assets, you can earn a return in two places at the same time, increasing your cash flow.

If you’re using Infinite Banking Concept strategy, you’re much more able to take advantage of other assets, because you’re much more nimble and have ready capital available. ~ Robert Murphy

Our Personal Story Illustrates Why Whole Life Is an Ideal “AND Asset”

Lucas and I were presented with the idea of infinite banking early on in our marriage, over ten years ago. We were saving 50% or more of our income at the time. Concerned about the dollar losing value, we were putting almost all of our savings in precious metals. We bought for several years when the price was low, all the way through the high.

Gold is more of a long-term play. In the short-term, betting on it is akin to speculation.

If we knew then what we know now, we would have put the money first into whole life, and later borrowed against it to buy the gold we wanted.

We encountered problems when we needed to use the money. Around 2012, we needed to liquidate our capital to start our business, but at that time, gold was losing value.

Had we started with whole life and continued our savings program, we would have had the gold AND the cash value. We would not have wanted to liquidate the gold at that time, but we would have been able to access our continually compounding cash value instead.

It’s No Secret That Banks and the Wealthy Store Reserves in Cash Value Life Insurance

Many big investment banks use Bank Owned Life Insurance (BOLI) on their employees, so it’s ironic that the commercial and investment bankers recognize the advantages of this structure. They use it, but don’t promote it or tell you to use it.

After the ’86 Tax Reform Act, wealthy individuals lost some of the tax advantages in real estate. There was a surge in the use of permanent life insurance policies, as they sought other assets with tax advantages. Shortly afterward, Congress amended the tax code to stop rich people from putting too much money in.

We’ll discuss in Why the Wealthy Love Cash, Part 2, how the ultra-wealthy hold a lot of cash because they’re looking for the right opportunities to invest in what they know and can control.

Conversely, the average person has heard for decades that they have to stay invested, even if they are losing money. They’re trying to ride the average rate of return in the stock market and handing their money over to someone else. They aren’t thinking about securing the means to find opportunities that align with their investor DNA.

The Mindset Shift Required to Take Control of Your Capital

Most business owners believe they can get the greatest returns in their business because it’s what they know and control. Consistently, most also fail to recognize the incongruence of investing money with much greater risk and lower rates of return on investments outside their control.

A mindset shift is needed to give yourself permission to store safe capital where you control it, and invest in what you know and control.

Doing so breaks the mold of the financial status quo. But it’s just what’s required to expand your options and protect your entrepreneurial ability to innovate in the future.

Create Your Time and Money Freedom

For more information on how to use Specially Designed Life Insurance to store cash, boost your returns on liquid capital, and maintain ready accessibility, get our free guide on Privatized Banking.

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd! And build a life and business you love.

Becoming Your Own Banker, Part 28: Infinite Banking Definitions

Have you ever felt like you’re on a financial hamster wheel, constantly spinning but never gaining traction? Join us as we unpack the epilogue and glossary of Nelson Nash’s “Becoming Your Own Banker.” It’s a journey through the intricate philosophy of IBC, as we cover Infinite Banking definitions that shows how effective money management can…

Read MoreNelson Nash’s Legacy: Think Tank 2024 Recap

Embark on a transformative financial odyssey with us as we reflect on our profound experiences at the Nelson Nash Think Tank for 2024. Unlock the doors to personal economic empowerment with the Infinite Banking Concept (IBC), a brainchild of the late Nelson Nash that revolutionizes the use of dividend-paying whole life insurance. We shed light…

Read More

[…] My interview on The Money Advantage […]

Thank You, Bob Murphy, for being our guest on the show!

I also think that it is better if a business doesn’t lack working capital. I think that with this, business will be able to grow. Thanks for sharing this article.

Glad you liked it!

Great article! This will definitely help me grow my business especially my working capital. I think that business working capital is really important for a business to expand so business owners must see to it that the business will be never be out of it.