How to Wean Grown Kids Off Your Payroll, Freeing Up Retirement Cash (Reviewed)

Many people get stuck paying their kids’ bills long after the kids are grown and moved out of the house. Often, it’s to the tune of hundreds, if not thousands of dollars each month. Even commitments you initially made because you love your kids and want to help them can begin to feel like a burden with no end in sight. It’s time to get your grown kids off your payroll.

The unwanted obligation can cause financial tension, strained relationships with your children, and even marital strife. It sucks up your cash flow, limiting your ability to create your financial freedom. And, it handicaps your kids, preventing their financial savvy you may have been trying to develop in the first place.

According to USA Today article, How to Wean Grown Kids Off Your Payroll, Freeing Up More Retirement Cash, by Adam Shell, having adult kids on your payroll is way more common than you’d think.

In fact,

Just because your kids have moved out of the house doesn’t mean they’re out of your financial life. Six out of 10 (61 percent) parents with at least one adult child over 18 said they provided them financial help, according to a Pew Research Center survey.

–Adam Shell, How to Wean Grown Kids Off Your Payroll, Freeing Up More Retirement Cash

Podcast: Play in new window | Download (Duration: 48:58 — 44.8MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

How to Draw the Line in the Sand and Get Your Kids Off Your Payroll

So how do you draw a line in the sand? How do you break free and get your life back without damaging the relationship? More importantly, how do you prevent the overextended welcome and accompanying resentment from becoming a problem in the first place?

If you’re a new or young parent, this conversation will help you think differently to create successful, self-sustaining kids.

If you’re finding yourself in the position of still paying bills for your kids today, even though you’re an empty nester, you’ll get great tips to cut the cord and transition your kids off your payroll.

Our review of this article, along with our personal experience and client conversations will help you unravel this delicate challenge. It will pave the way to healthier communication, stronger family relationships, and greater financial confidence.

Where Weaning Your Grown Kids Off Your Payroll Fits in the Cash Flow System

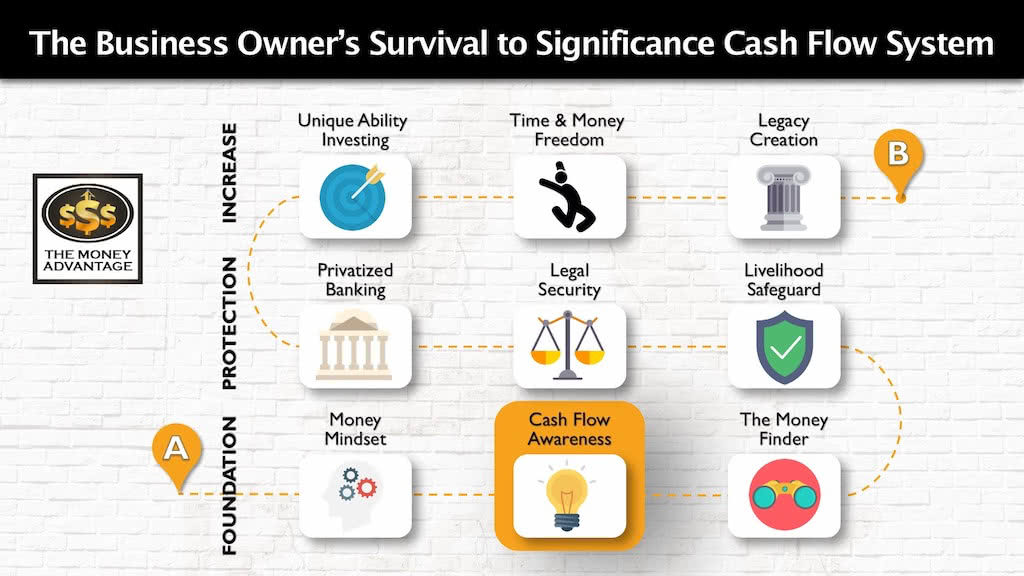

We’ve put together the Business Owner’s Cash Flow System to help you through all three steps of achieving a life of significance as you create financial freedom. First, you build a foundation to help you keep more of the money you make. Then you protect your money. Finally, you get it working for you to increase your cash flow from assets.

So where do your financial decisions about your kids fit into the big picture?

Transitioning your kids off your payroll is a complex topic that connects to multiple parts of your financial life.

Most directly, we’re talking about how to increase your cash flow, so you have more to protect and invest.

But moving your kids out of your financial life also has roots in your mindset and long-term impacts on your legacy.

Why It Becomes Necessary to Wean Your Grown Kids Off Your Payroll in the First Place

Knowing what to do to correct a problem is much easier when you understand why the problem exists in the first place. So why is paying for grown kids’ expenses so common, even after they move out of the house?

The Complexity of Financial Decisions

We’d like to think that the way we make decisions is 100% logical and always consistent with our value system.

However, our financial choices are extremely personal and emotional. They’re based on your personality, identity, and relationship factors. Often, we do what seems easiest or feels best in the moment without much critical thinking or self-awareness at all.

Reasons We Keep Paying Kid’s Expenses

Because we’ve been financially responsible for these humans in our life from the start, it’s not always self-evident where the responsibility stops. You can wind up continuing to pay expenses because that’s what you’ve always done, especially if there was never a conscious decision to change course.

Your history of covering their living expenses sets up your kids’ expectation that you’ll pay the bills in the future. And, since you don’t want to disappoint them, you feel it’s necessary to uphold your end of the deal. You may feel that you’ll risk them being angry with you if you don’t follow-through.

Often, we sincerely want to be helpful. You may doubt that the kids are able to manage their money responsibly, pay their bills, maintain their credit, etc., so you jump in and break their fall.

The Outcomes We Want

But if you want financial stability in your own life, you have to take control of your spending. Even if that’s your spending on behalf of your kids.

As for the relationship element, if you desire wholesome, healthy relationships, you build them through honesty and free choices, not on a sense of obligation.

And if you want to foster autonomy, confidence, and freedom in your kids’ lives, you must allow them room to fail, learn from their mistakes, and recover.

So, let’s find better ways to create the outcomes we want, shall we?

Before It’s a Problem: Setting Up Your Kids for Financial Independence Ahead of Time

The first step to weaning your kids off your payroll is to prep them for success, says Adam Shell.

Financial education is a preventive measure that takes time, patience, and modeling, but it’s not something you can shortcut. The school system isn’t equipping kids with financial savvy. You as the parent are the responsible party.

Paying for everything for your kids is a Band-Aid to the issue of developing their financial IQ. Rather than throwing dollars at your kids by paying for everything, start by teaching them how to make money, so they can buy whatever they want.

It’s the idea that you can give a person a fish and feed them for the day, or you can teach them to fish, and you’ll feed them for life.

Financial Education

The article mentions these things on the “need-to-know” list for kids:

… basic personal finance techniques, such as avoiding credit card debt, basic budgeting, how interest rates impact monthly payments on cars and homes, and the benefits of saving early for retirement in a 401(k) or other investment savings plan.

Adam Shell, How to Wean Grown Kids Off Your Payroll, Freeing Up More Retirement Cash

However, because personal finance is such a comprehensive topic, we’d advocate a different list. Here’s our starting point of what they’ll need to know to not only survive, but thrive financially:

- How to make money in the first place

- Vision and goals of what they want to create

- Cash flow awareness

- Managing their cash, including an understanding of paying bills, and the difference between fixed payments and discretionary income

- The value of saving and paying themselves first

- What it means to invest, especially the importance of getting money to work for them in cash-flowing assets they know and control

- The difference between saving and investing, and why retirement plans aren’t ideal for either

- Paying a percentage of earnings in tax is necessary and requires planning

- The value of insurance protection

- Building credit

- Borrowing and repaying loans, what debt is, and the best way to pay off loans

You can see that this isn’t as simple as knowing how to balance a checkbook and stay out of debt.

So how do you fit it in and build fiscal fitness? You don’t cram for the exam the day before. Start long before kids move out of the house to build solid, age-appropriate foundations.

Teach Kids How to Make Money

When kids are young, teach them the abundance principle that

Dollars follow value.

Let them come up with ways they can deliver value above the family expectations and chores. If it’s your child’s responsibility to clear the dishwasher and take out the trash, don’t pay them for that. However, if they want to clean the gutters, rake the yard, or do the spring window-washing, give them the opportunity to earn income as they’re providing extra value.

Help them discover what they love and are great at that other people value them doing and translate that into money-making endeavors.

Kids are innovative and entrepreneurial at heart, and often love the idea of making money. If they’re great at sales and have a passion for animals, perhaps they could start a dog-sitting business or charge neighbors to walk their dogs. Maybe they could make and sell jewelry or artwork, have a bake sale or lemonade stand, start a YouTube channel, teach gymnastics, or take neighbor’s trash to the street each week.

The Cash Flow Game, by Robert Kiyosaki, is a fabulous, tangible tool that can give kids a grasp of what it means to create financial freedom in the real world through assets.

Teach Cash Flow Management

I love the book, The Opposite of Spoiled, by Ron Leiber, as a resource for opening up the dialogue with kids about making and managing money.

We break down any money our 7-year old daughter earns or receives into three categories: 10% to giving, 40% to saving, and 50% to spending.

The giving money is to teach the importance that there’s always more than enough to be a blessing to others. Her savings is for something that will make her money, like business start-up capital. And she can use her spending cash now or store it up for something bigger. If you ask her, she’s saving it up for a puppy or a horse.

In his book, Profit First, Mike Michalowicz suggests a radical idea for kids when they first start earning income or an allowance. He says to designate a small percentage to pay back to the family for living expenses, i.e., 5%. This solidifies the idea that there’s a regular cost of living and planning for it becomes natural, instead of a big shock later on.

Create Shared Family Decisions and Values

Also, communicate about your personal financial values and spending decisions. They’ll develop good money habits by watching you model them. Don’t just go through the motions, but explain what you’re doing, why, and how it relates to your values.

This will help them learn to self-regulate as they understand opportunity cost (if you spend on one thing, you close the door to spending that same money another way you might have liked).

For example, within age-appropriateness, let your kids in on deciding how the family will spend their fun plan. Currently, our family is holding off on eating out as frequently, to plan to buy bikes and a bike rack for fun family adventures. We all made the decision together, and we’re committed to following through together.

If they’re older, maybe they participate in the decision whether to go on a big summer vacation or put in a pool.

As kids age, let them in on the regular expenses that you pay to keep the family operating. Let them see your spending plan and expenses. Mint.com is my personal favorite for this. Show them the cost of groceries, gas, the mortgage, insurance, extracurricular activities, entertainment, etc.

Seeing the numbers needed to live the lifestyle they’re familiar with will bring awareness. This opens the door to discussing what is important to each person and helps create a unified family value system.

Pre-Determine Your Transition Point and Communicate About it Early

Humans don’t handle change well. Even those of us who live most spontaneously like structure, consistency, and predictability. So, rather than springing the topic of paying their own bills for the first time in the heat of an argument with your 18-year-old, talk with them ahead of time about how and when they’ll start paying for things themselves.

This brings up the question of when the right time is to transition.

When Should You Transition Your Kids Off Your Payroll?

Since you have your own family dynamics, no one rule will work for everyone. However, here’s a good guideline: when kids graduate high school, offer a timeframe that they need to have a source of income and either move out or pay rent, along with taking on financial responsibility for all of their own expenses.

If they have a job or business earlier, make that the starting point to take on their own bills, or transitioning appropriate bills over time.

The next question, is which bills?

Which Bills?

Here, you’ll want to list out everything you’re paying on their behalf. You may be paying car payments, gas, auto insurance, health insurance, credit card bills, the cell phone, college loans, food, and “rent.”

The list is usually surprisingly longer and more expensive than either you or your kids had realized.

For instance, while they’re still in high school, maybe you pay for the car so they can get to and from work and school, but they cover insurance and gas. Perhaps you co-sign student loans for them to get into college, but it’s their responsibility to make the payments after they graduate college.

After the Problem Already Exists: How to Correct Unhealthy Patterns

I want to talk directly to those of you who are already in the damage control zone. Maybe you haven’t modeled or taught financial responsibility, and you’re already stuck paying unwanted bills for the kids.

You’ll need to accelerate the process and jump right to the transition.

The Right Time to Kick Your Kids Off Your Payroll

If your kids are already out of the house, it’s time to exercise tough love and take them off your payroll.

If you’re trying to determine when is the right time that you’re 100% confident they won’t mess it up, you’ll never feel like they’re completely ready.

Adam Shell says that cutting the cord depends on your child’s cash flow.

However, if you’re waiting for the perfect moment when they’re a millionaire or have no money worries before you hand over the responsibility for their financial life, they’ll never get there. And they’ll never develop the discipline, accountability, and habits necessary to become successful in the first place. Part of becoming an adult and building financial muscle is exercising self-control, having to choose what’s most important, and forgoing things we want that we can’t pay for.

If they aren’t currently financially stable, set a date that you’ll stop paying all their bills. And follow-through.

Don’t Put it Off

Start by committing to handling this as soon as possible.

An ongoing problem continues to become more entrenched and harder to correct, the longer it persists.

Have Candid Conversations

We might think we’re maintaining the peace by dancing around difficult subjects. Frankly, many people are simply not equipped with the emotional intelligence to know why they’re feeling frustrated, what need they’re trying to fulfill, and how to communicate those needs in a way that everyone gets what they want. The good news is that there are many transformational resources available, so up leveling your ability to handle difficult conversations and improve your relationships is within your power to reach. The book, Nonviolent Communication, by Marshall Rosenberg, is one such tool.

This powerful TED Talk on Radical Candor points out that honest, transparent conversations are needed at the core of great leadership in a work environment. This translates to the home environment as well, where strong and healthy relationships start with honesty and seeing each other as you are.

Your Needs

Talk

Communicate that you want them to be self-sufficient so that they can build their own confidence, autonomy, and financial freedom.

Your needs are just as vital, critical, and relevant as theirs. They’re grown. They can handle you being real with them.

The Facts

Next, it’s time to account for everything you’re currently paying for them and total it up. Refer to the list we mentioned earlier.

Action Plan to Get Your Kids Off Your Payroll

Create an action plan together for each item. The key here is communication. You need to be clear, direct, and leave none of their questions or caveats unanswered.

If they have a job, they can move to an employer’s insurance and get off the family’s medical plan. If their employer doesn’t offer coverage, have them pay you for their portion of the insurance bill.

If you choose to keep them on the family plan for insurance or cell phone service, then make sure you have them pay their portion of the plan.

Transfer bills into their name and make sure they’ll arrive at their address instead of yours.

Put important bills on auto-draft from their account, so that they’ll be consistently paid on time. Recommend using mint.com to track their spending so there’s enough for necessary expenses. Then, they’ll know the essentials are covered before any discretionary spending happens. Set up automatic transfers to savings. Then, they’ll build up an emergency fund for the bills they might

Communicate that you won’t be bailing them out.

Let them know you believe in them, and they can do this.

A Few Points we Diverge

The End Goal: Retirement vs. Financial Freedom

While the article, How to Wean Grown Kids Off Your Payroll, puts forth a great effort towards solving a tremendous concern among American families, we disagree about the end goal.

Increasing your cash flow is not for the purpose of freeing up retirement cash. Frankly, if you’re waiting until your kids are out of the house to think about planning for your own future, your chances of success of using typical finance are slim.

The purpose of increasing your cash flow is to have more to save, protect, and invest in cash-flowing assets. Building financial freedom is far better AND more achievable than planning for retirement, anyway.

Life Insurance as a Legacy Transfer and Family Bank

The article discusses lowering your life insurance coverage if you don’t have kids at home to support, college tuition is paid, and your mortgage is nearly paid off. This thinking is congruent with typical financial advice, based on a needs analysis. However, we disagree, as this could be a huge mistake when buying life insurance.

Life insurance is not about the minimum that you need. Instead, it’s about having the maximum to create what you want to happen.

Life insurance is also a tremendously valuable legacy transfer tool. It allows you to best pass on wealth and set up future generations for success.

If you’re using whole life, the cash value can also serve as a family banking system. This provides capital available for the family’s emergencies and opportunities. You can surround the disbursement of life insurance l

Children could borrow for college funding, a home purchase or the seed capital for a business venture. But if, and only if, the family deems the loan to be low-risk, and highly likely to be repaid.

Pass on a Legacy of Wisdom, Not Just Money

Earlier, we discussed the value of giving your children

In his book, Entrusted: Building a Legacy that Lasts, Andrew Howell articulates a tragically missed opportunity when families pass

Instead, commit to developing your own financial acumen and educating your kids on creating, growing, managing, and maintaining wealth.

Plan Now to Wean Your Kids Off Your Payroll

Increasing your cash flow is an essential foundation to building time and money freedom.

So, wherever you find yourself today – pre-kids, with young children, or with adult kids – create your plan to wean your kids off your payroll.

Recognize the human tendency without personal leadership and intention is to pay for kids’ expenses forever. Work instead to create a different reality for yourself and generations after you.

Start now to break the cycle. Even more than just creating good money habits for yourself, you’ll be equipping your kids to be self-sufficient, building their confidence and autonomy.

In the process, you’ll also become happier and healthier financially. Guaranteed.

Book a Call to Find Out Your Next Step to Time and Money Freedom

Contact us to find out the one thing you should be doing today to accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreSurviving the Storm: Navigating War in Israel with Rabbi Lapin

When war across the world could mean war close to home or a whole world war … when conflicts thousands of years old can’t be solved overnight … when truth seems defined by who’s in power … when totalitarianism seems stronger than freedom and free markets … when open borders looked like compassion but instead…

Read More