Profit Maximization: Find and Fix Your Money Leaks

The best profit maximization strategies are the ones nobody’s talking about. Why? Because everyone is looking for the hardest, most challenging, and over-complicated techniques. Maybe it’s our human tendency to believe that everything worthwhile has to be difficult. Or perhaps, we like the bragging rights we get after surviving the most grueling, tortuous feats. Like cutting all carbs, sugar, and flavor for seven years with no cheat days. Or making getting fit as hard as running the Boston Marathon.

When it comes to your money, you’re working hard to make it in the first place. You’re balancing enjoying life today with making sure tomorrow is secure, and taking care of your future needs, like cars, college, weddings, vacations, and personal income. As most people do their best to cover all the bases, they usually fall into one of three self-defeating traps.

Podcast: Play in new window | Download (Duration: 48:22 — 55.4MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

The Three Profit Maximization Traps

The first trap is trying to work harder to make more money. But this quickly turns into a rat race to stay ahead. Often lifestyle expenses creep up along with income, and they wake up to realize they’re using up the same portion of a bigger pie. This frantic, unsustainable pace of outworking your spending can lead to burnout.

The second trap is feeling the need to take on more risk to grow money faster. But

The third trap that lures and then confounds even the most financially disciplined is cutting back. They try to live on

Profit Maximization Is Easier Than You Think

Instead of falling into those traps, thankfully, the keys to profit maximization are more like finding out that to be the healthiest and most fit, you can eat, drink, sleep, and exercise however much or as little as you want. Well, almost that easy. (And, of course, health doesn’t work that way.)

The best-kept secret to

That’s why it’s our mission to help business owners increase profits by doing just that.

We’ll help you avoid the self-defeating traps that will have you burned out, losing money, and hating life.

Instead, we’ll show you the most common money leaks

Where Profit Maximization Fits into the Cash Flow System

Maximizing your profit, so more of the money you make is yours to keep, is just one part of a bigger journey to building time and money freedom. You could be making a great income, but still, be missing key components of creating a sustainable lifetime of wealth.

No matter how big your business grows and how much money you make, if it’s all leaking out between your fingers, you’ll never be free of just working harder and harder to make more money. You’ll never build the peace of mind that comes from having reserves, protection, and assets that work harder for you than you can work for yourself. At some point, the job of earning money is a baton that you need to pass to cash-flowing assets that can keep chugging along, spitting out income the rest of your life so that you can enjoy time freedom.

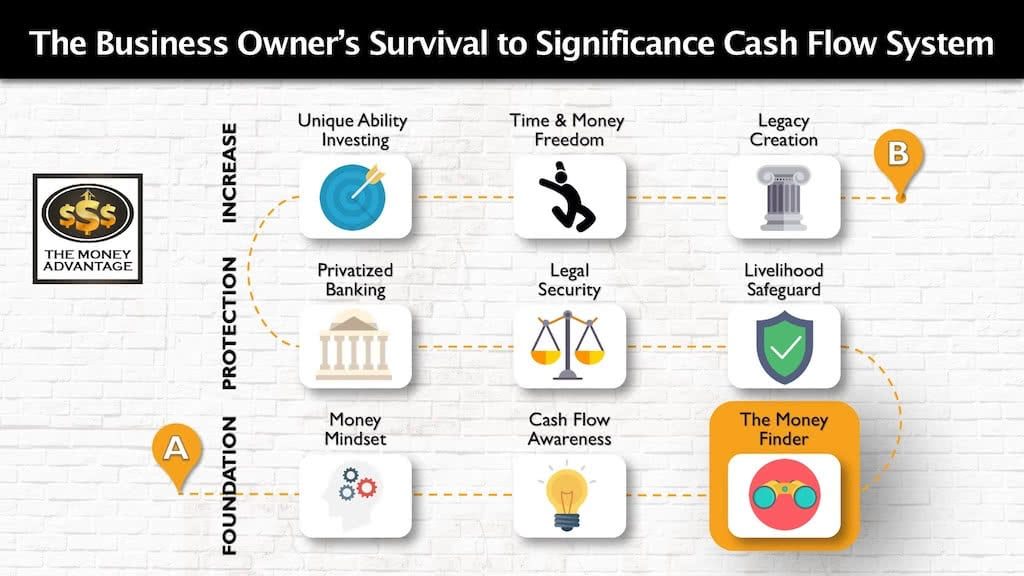

That’s why we have created the 3-step Business Owner’s Cash Flow System, your roadmap to take you from just surviving, to a life of significance, purpose and financial freedom.

The first step is keeping more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you’ll protect your money with insurance, legal protection, and Privatized Banking. Finally, you’ll put your money to work, increasing your income with cash-flowing assets.

Profit maximization happens right here in The Money Finder step of your financial foundation. When you find, recover, and keep more of the money you’re making, you put more gas into your cash flow machine. And that accelerates your time and money freedom.

What Is A Money Leak?

Most people have no idea that they have money leaks. That’s why they’re rarely talked about as a concern or as a problem requiring a solution.

But money leaks are like a ruptured aneurysm. They’re invisible, but fatally dangerous.

Money leaks are all the ways you lose money without trying. It’s the spaces in your financial life where money is unintentionally leaving your control.

Like a leaky hose, a lot of money might be coming in, but it’s being lost along the way. Most of the water is spraying out through breaks, tears, cracks, and punctures, with barely a trickle dripping out of the other end of the hose.

Money Leak Symptoms

As with a medical condition, it’s usually the symptoms that bring you to the doctor’s office in the first place.

Since you can’t actually see the money leak itself, here are the warning signs to detect this money flowing out of your control.

You know you have money leaks if you are working hard, but not proportionally keeping 20 – 30% of your income.

At the end of the month, you have little cold, hard cash to show for how much you made.

Your savings isn’t growing.

And month after month, you’re not feeling any closer to your financial goals, even though you’re making a lot of money.

The Eight Profit Maximization Keys to Find and Fix Money Leaks

Here is the treatment plan for finding and fixing money leaks with the easiest, least painful moves to increase your financial efficiency.

#1) Cash Flow Awareness

One of the biggest losses happens when you’re simply not paying attention to your spending.

If you’re not tracking your money regularly, you’ll have expenses flowing out under your nose without being detected.

To fix this, use the Cash Flow Awareness exercise to make sure you are spending on what’s most congruent with your values and mission.

Then track your money on a weekly or monthly basis and set up regular meetings with financial decision-makers to monitor your inflows and outflows.

#2) Taxes

Taxes take up a big chunk of your earnings. Saying it makes me Captain Obvious because you positively didn’t need me to tell you that.

When you add up everything you pay, between federal, state, and municipal taxes, self-employment tax, property tax, sales tax, gas tax, etc., it’s a hefty sum, often towards the 40% range of your total income.

So how is this a money leak? Well, most people pay more tax than they legally need to.

Written right into the tax code are lots of options for people with businesses and real estate to minimize their taxes. It’s the government’s incentive for you to flourish as you add value to the economy. But, finding all of the ways the tax code applies to you takes a proactive CPA or tax strategist.

Strategies to Minimize Taxes

To pay your minimum tax, here are a few options – but please, first consult with a qualified CPA or tax strategist to determine you use the right strategies for your situation and implement them correctly.

Ensure you have the right entity type set up for your operation.

Depending on your entity type, you may be able to shrink your W-2 wages and take the rest of your income as a distribution, minimizing how much is subject to the 15.3% self-employment tax.

Discover every expense that has a legitimate business use and

With the tax code changes in 2019, your business may qualify to receive the 20% flow-through deduction.

Here are two of the more sophisticated strategies. Corporate rent allows your business to rent your personal residence, creating a business deduction and non-taxable personal income to you. Using a cost segregation study gives you the ability to depreciate parts of your building more quickly.

And the 1031 exchange allows you to postpone capital gains tax when you sell one piece of real estate and use the earnings to buy another property.

#3) Debt

Debt is another biggie that creates massive money leaks for many people, primarily because of a misunderstanding of what debt is. Just because you have a loan doesn’t mean you’re in debt. A debt position is when you owe more than you own, or your assets are worth less than your liabilities.

More specifically, a negative, guilt-driven mindset about liabilities and loans in the first place is what causes a rush to pay off loans as fast as possible. The goal might be to pay off the loan and free up the cash flow in the future. But in the meantime, all of today’s spare cash is gobbled up in the process, creating the opposite of profit maximization.

Instead, to maximize profit, you want longer repayment periods, because this creates smaller payments.

Secured loans are safer and less risky to the lender, warranting lower interest rates for you and also shrinking your payments.

Deductible loans are preferred, over non-deductible loans, because the interest creates a tax write-off, adding more money back to your pocket.

If you can consolidate loans to hit a few of these targets: lengthening the repayment period, increasing deductibility, and moving to secured loans, consider this to increase cash flow.

If you do want to pay off loans, prioritize the ones the free up the most cash flow by using the Cash Flow Index.

And always, emphasize building up the asset side of your portfolio over shrinking the liability side. Reserves in your control will give you the ability to consistently make payments on time, even during tight months. These consistent payments will boost your credit, lowering your interest rates, and further increase your cash flow.

#4) Savings and Investments

Your savings and investments should move you closer to time and money freedom. If they’re not, they’re a money leak, draining your energy and efforts.

To fix this money leak, save and invest where you have knowledge and control. Build savings in assets that won’t lose value, are liquid and accessible, and have the most consistent, compound, competitive growth. One of the best tools to accomplish this safety, liquidity, and growth is with the Privatized Banking strategy.

And then, rather than following status-quo, typical investing strategies and putting money into qualified retirement plans that you have no control over, little liquidity, and high potential of loss, invest in assets that produce cash-flow, where you’re minimizing risk through knowledge and control.

#5) Protections

Without protection, you’ll always have a subconscious worry that your efforts could be wasted, stolen, or lost. But the key making sure your protection isn’t a money leak is buying the most, while paying the least. Then you’ll ensure that you’re paying for your insurance in a way that maximizes your profits.

Bundle your lines of insurance under one company to get a multi-line discount.

Build savings. With adequate savings, you can increase your deductibles on your business, liability and health coverages, and lengthen your elimination period on disability insurance. These coverage shifts can make your dollars go much further by reducing costs.

Switch single-use insurances for a more versatile product. The primary place we see this strategy is with Long Term Care insurance. LTC has become over-priced because companies didn’t anticipate Americans living so long or having such high costs during their later years. Instead of purchasing a product that only covers you for long-term care needs, consider a rider on a whole life insurance policy that allows you to accelerate the death benefit if those costs were to arise. The life insurance policy is far nimbler, as it can also be used as an emergency/opportunity fund for personal or business use during your lifetime.

My favorite profit maximization tip with insurance is to buy an umbrella policy. That goes for your business and your personal life. Instead of only maxing out the liability coverage of underlying policies, which is much more expensive coverage, get at least the minimum to qualify for the maximum umbrella policy you can get. Umbrella coverage is much cheaper per dollar of coverage than the underlying policies. You may pay an extra $1000/year to add $50,000 of liability coverage to your auto policy, but only $300/year to add a $2 Million umbrella policy.

#6) Efficiency

To maximize your profitability, find ways to make equivalent efforts go further. In doing so, you’ll increase your output without increasing the input.

One way to do this is to find a way to serve more people. Maybe you repurpose materials for individual training and use them for group coaching or an online course.

As often as possible, implement routines, systems, and processes that can be replicated, instead of re-created. You’ll use less time and money each time you recycle the same efforts.

#7) Abundance perspective

The biggest money leak is the income you never created in the first place because you weren’t in the right mindset to dream up the idea or put it into action.

To correct this money leak, stay in an abundance perspective, focusing on ways you can create value.

Exercise self-awareness to discover what you love that you’re great at, that the world needs and will pay you for. Then cut out energy-draining activities, like clients you don’t enjoy working with, or tasks outside your unique ability that someone else is excellent at.

Focus your attention on what gives you the greatest results by using the E.L.F. model to find what’s easy, lucrative, and fun.

And elevate the value you provide by adding bonuses, add-ons, or improving the experience for your clients.

#8) Prioritize Profit

You’ll get what you focus on. Therefore, the absolute, most essential key to maximizing profitability is to prioritize profits! Rather than waiting until after all your expenses are paid to come up with your profits, take your profit first.

This is akin to the wealth principle of paying yourself first. After you’ve taken your profits and savings, spend the rest. It’s a surefire way to make profits happen and guarantee you don’t put them on the back burner.

One key way to do this is to set up the Profit First accounting system, by working with our team. Our tax strategists not only have the superpower of helping you pay the minimum legal tax this year and every year going forward. They’re also certified Profit First Professionals who are well-versed in teaching you how to use the Profit First system.

Profit Maximization Isn’t Hard

Did you notice that not one of these strategies had you working harder? None brought on a cloud of doom about a painful conversation you’ll need to have with your spouse (or yourself) to restrict spending and tighten up the budget. And not one peep about doing something risky.

It’s time to let go of the idea that the only way to keep more money is by doing something hard. Instead of working harder and getting burnt out, taking more risk and possibly losing everything, or cutting back and being miserable, use these eight profit maximization keys. They’ll help you reach the nirvana of keeping more of your money with the easiest, least painful moves.

Get The Top 3 Money Finder Strategies

Now, just because keeping more money is easy, we didn’t say it wasn’t a tad overwhelming.

If you’d rather focus on

Along with the cheat sheet, you’ll also get a case study showing how one business owner used these three strategies to increase cash flow and keep $97K more per year than he was already making, without working harder, taking on more risk, or cutting back.

AND, we’ll throw in our 3-step roadmap to building time and money freedom, so you can see where this fits in the bigger picture.

Your Next Step to Profit Maximization

And, if you’d like help determining your specific steps to the profit maximization strategy for you, so you don’t have to figure it all out for yourself, book a call so we can show you the way. You’ll see exactly how to keep more of your money, so you can have more to save and invest. You’ll find out the one next thing you need to do, based on your unique situation, to accelerate time and money freedom.

PS…if you do decide to work with our team, you’ll get access to our tax strategist. They’re a Profit First Professional, trained in implementing the Profit First accounting system to prioritize and maximize profit.

If this is important to you, get started today!

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

How to Pay Less Tax

Concerned about taxes in the future? Taxes are a huge eroder of wealth. While you do not have control over tax rates, you can strategically position yourself to maintain control of as much of your money as possible. Taxes are at a historic low, so it is time to learn how to pay less tax…

Read MoreTax-Free Retirement is a Bad Idea

Want tax-free retirement income? Tax-free money in retirement sounds amazing… at first glance. But before you dive into this strategy, there are three things you need to know about why “Tax-Free Retirement” is a really bad idea. To find out exactly why you shouldn’t set up your financial game plan for tax-free retirement… tune in…

Read More